The general perception has been that the pandemic would radically increase employees’ appreciation of benefits and possibly increase their need for certain benefits, but how benefits may evolve based on these changes remains unclear.

With the pandemic shaking the country for more than 12 months now, employee benefits experts are trying to gain insights into which actions employees will take as a result of COVID-19 and whether carriers will see a positive impact on participation rates. The general perception has been that the pandemic would radically increase employees’ appreciation of benefits and possibly increase their need for certain benefits, but how benefits may evolve based on these changes remains unclear.

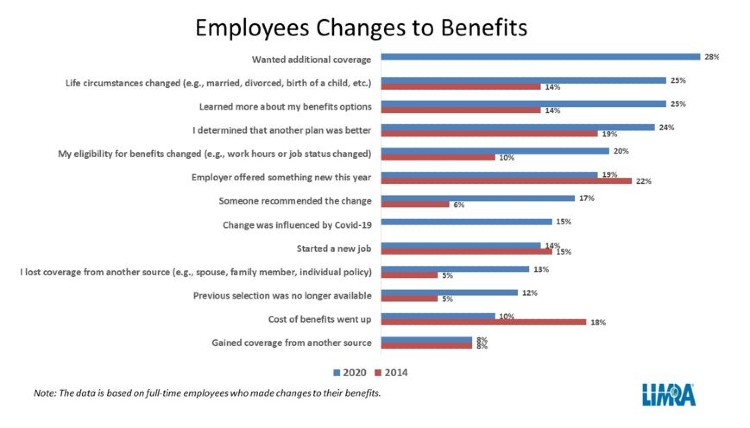

A recent study by LIMRA found that in 2020, a smaller percentage of people (26%) made changes to their benefits compared to 2014 (36%). This is a clear indication that many employees, pressured by immediate financial concerns, opted to exercise a conservative benefits strategy approach. This was especially evident after identifying when individuals were making changes, what changes they made, and their reasoning behind the change.

Enrollment Timing Mattered

As the pandemic progressed, employees approached the challenging environment differently. Employees who had their open enrollment period in the beginning of the year were more likely to make changes to their benefits (48%) than employees who were making decisions in the fall (23%). Millennials and younger employees became champions in making changes, while just a fraction of boomers changed their benefits plans during the pandemic. Meanwhile, 24% of Generation X and 36% of employees aged 18 to 39 made changes to their plans.

The majority of employees who made changes to their benefits package added or increased coverages (77%), while only 35% of employees reported having dropped or decreased coverage.

Related: COVID-19 changes to enrollment likely here to stay

The top three benefits employees added or increased coverage for were life insurance, medical insurance and dental insurance. These choices were consistent throughout all enrollment periods, whether early in the pandemic or later in the fall. While we can certainly infer that COVID-19 highlighted the need for those benefits, in fact, these insurance coverages were often a priority for employees even before the pandemic.

The Impact of COVID-19

It appears that the pandemic has played both a direct and an indirect role in employees’ decision-making. While only 2% of employees said that COVID-19 alone drove their benefit decisions, 16% stated that the changes they made were influenced by the impact COVID-19 had on their households. Among the reasons given for their decisions, the basic desire for additional coverage topped the list, along with changes to life circumstances. Employees also noted a better understanding of the options available to them.

The rising cost of benefits, especially the ongoing costs associated with medical insurance, have always been a factor in employees’ decisions, but was less so in 2020 than in prior years. In fact, employees were far more likely to indicate a change in life circumstances or a better understanding of their options as driving their decisions than the rise in cost of benefits.

Taking into account the aforementioned factors, we should expect employees to continue to follow a conservative decision-making process driven by personal circumstances rather than by purely financial decisions, at least in the short term.

Yuliya Babushkina joined LIMRA in 2004. Her responsibilities include managing U.S. group dental surveys and various studies in workplace benefits research, such as the Conference Practices Survey, Broker Panel Surveys, and the Dental Metrics Survey. Her current area of concentration is health care reform and its effect on employers, employees, carriers, and brokers.

This article is provided by NAIFA partner LIMRA. For members, you can learn more about LIMRA and how to partner within the Member Portal.