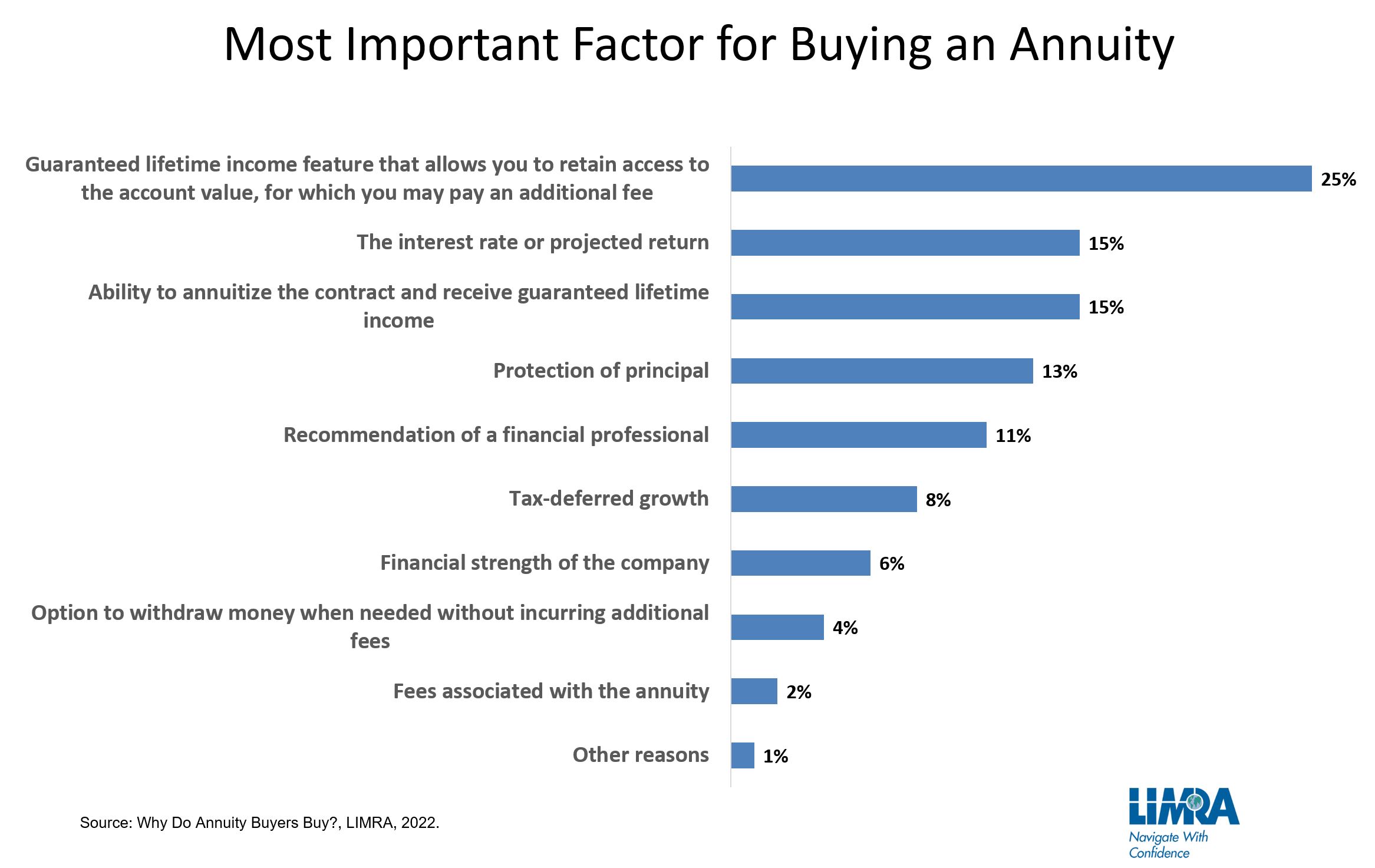

How workers’ need for lifetime-guaranteed income may drive more Americans to consider annuities

The goal of a successful retirement is to have enough guaranteed income to cover basic living expenses and not have to worry about running out of money for the rest of your life. According to recent LIMRA research, workers today do not feel that their households will receive enough lifetime-guaranteed income to cover basic living expenses throughout retirement.